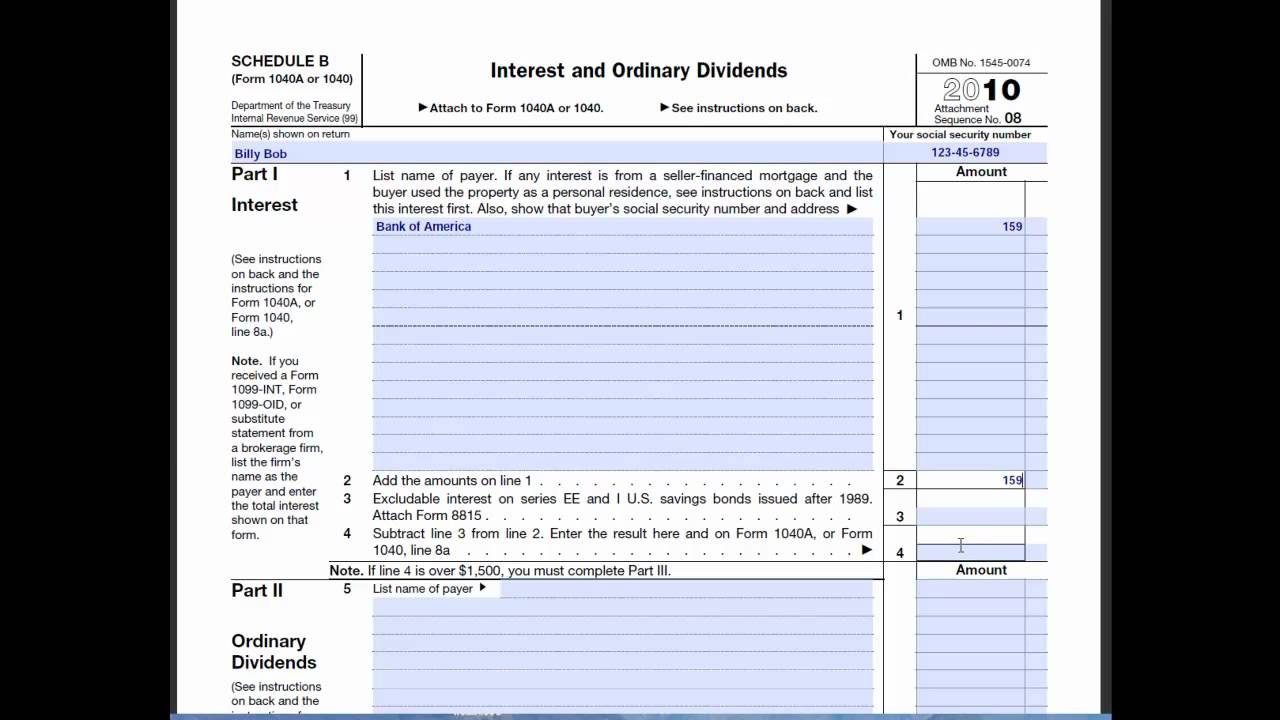

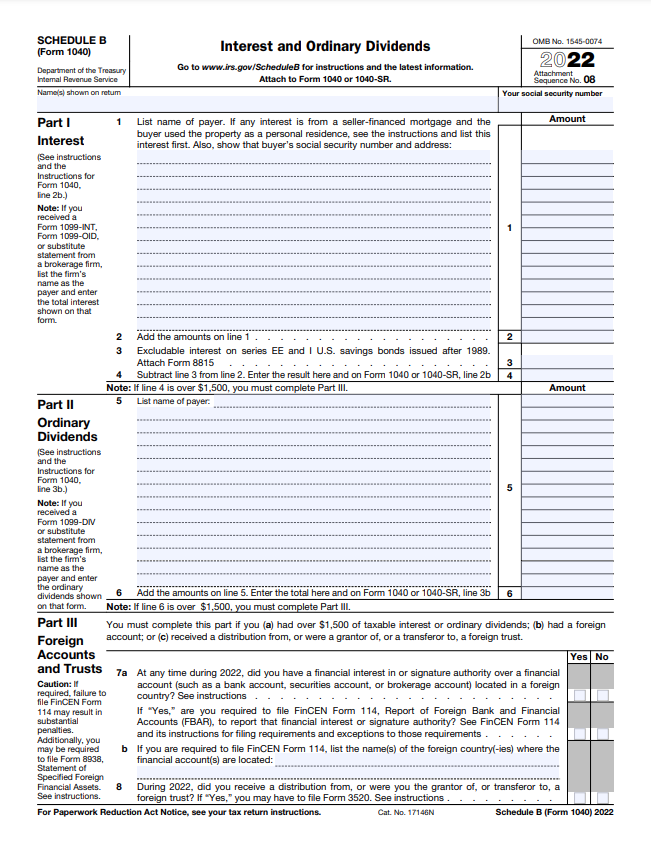

Form 1040 Schedule B 2025

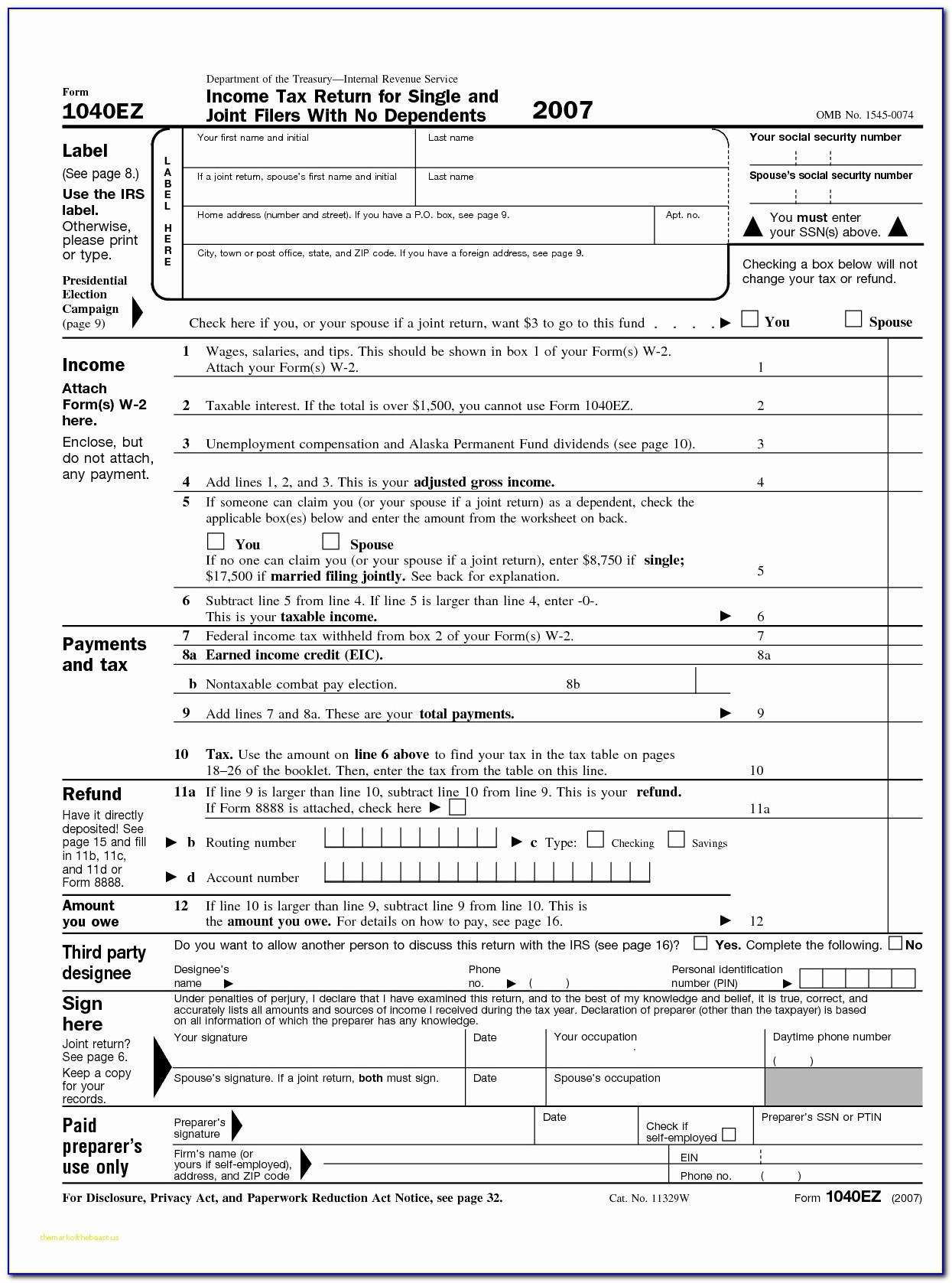

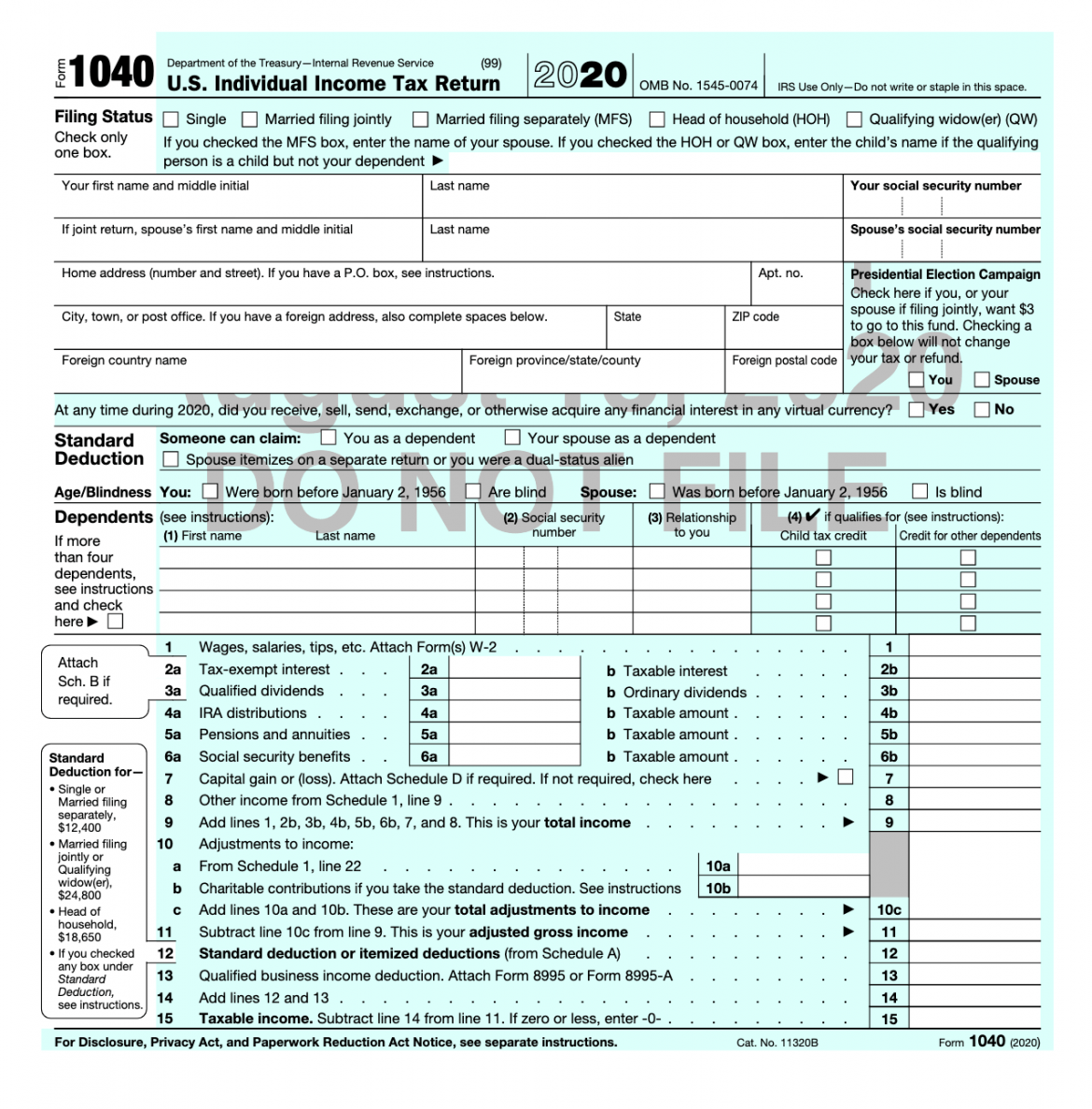

Form 1040 Schedule B 2025 - Form Schedule D (Form 1040) For 2025 A Comprehensive Guide Cruise, Its primary purpose is to report interest and ordinary dividends earned from various sources, such. What is IRS Form 1040 Schedule B?, A schedule b irs form reports taxable interest and dividend income received during the tax year.

Form Schedule D (Form 1040) For 2025 A Comprehensive Guide Cruise, Its primary purpose is to report interest and ordinary dividends earned from various sources, such.

St Paddys Day Parade 2025. With celebrating parties at all the irish hotels, pubs and […]

Irs.gov Form 1040 Schedule B at viiarmandoblog Blog, 1040 schedule b is an auxiliary tax form that serves as an extension to your main tax return, specifically form 1040.

To file schedule b, you must first gather all your documents and information about your interest and dividend income. 1040 schedule b is an auxiliary tax form that serves as an extension to your main tax return, specifically form 1040.

2025 Irs Schedule B Roxana, Form 8958, allocation of tax amts between certain individuals.

:max_bytes(150000):strip_icc()/ScheduleB-InterestandOrdinaryDividends-c6ff80bf2c1f4de981e0b0625a4e3dc7.png)

Irs.gov Form 1040 Schedule B at viiarmandoblog Blog, Request for transcript of tax return.

Schedule B (Form 1040) YouTube, This schedule is used to report income from.

Schedule B Explained IRS Form 1040 Interest and Dividends, Lenders charge borrowers interest for using their.

Form 941 2025 Fillable Schedule B Penelope Gill, Its primary purpose is to report interest and ordinary dividends earned from various sources, such.

Form 1040 Schedule B 2025. 1040 schedule b is an auxiliary tax form that serves as an extension to your main tax return, specifically form 1040. Most taxpayers only need to file a schedule b if they receive more than $1,500 of taxable interest or dividends.

:max_bytes(150000):strip_icc()/ScheduleB-242b09fcee984e15970defa3b2dd5e1e.jpg)

2025 Schedule 1 Form 1040 Ivonne Oralla, Form 1040 schedule b is a supplemental form used to report interest and ordinary dividends earned by an individual during the tax year.

:max_bytes(150000):strip_icc()/ScheduleD-CapitalGainsandLosses-1-d651471c24974ac79739e2ef580b1c35.png)